At NerdWallet, we strive to help you make financial decisions with confidence. To do this, many or all of the products featured here are from our partners. However, this doesn’t influence our evaluations. Our opinions are our own.

Getting a small business loan is a major hurdle facing small businesses, mainly due to tight lending standards by banks. But obtaining outside financing is often necessary to start or grow a business or cover day-to-day expenses, including payroll and inventory.

Although finding, applying for and getting approved for small business loans can be difficult, the more prepared you are, the better. Here’s how to get a business loan in five steps:

Get Your Free Personal Credit Score Every Week from NerdWallet

- Open more doors for financing your business.

- Set your goals and track your progress.

- Signing up won't affect your score.

1. Ask yourself, why do I need this loan?

Lenders will ask you this question, and your answer will likely fall into one of these four categories:

-

- To start your business.

- To manage day-to-day expenses.

- To grow your business.

- To have a safety cushion.

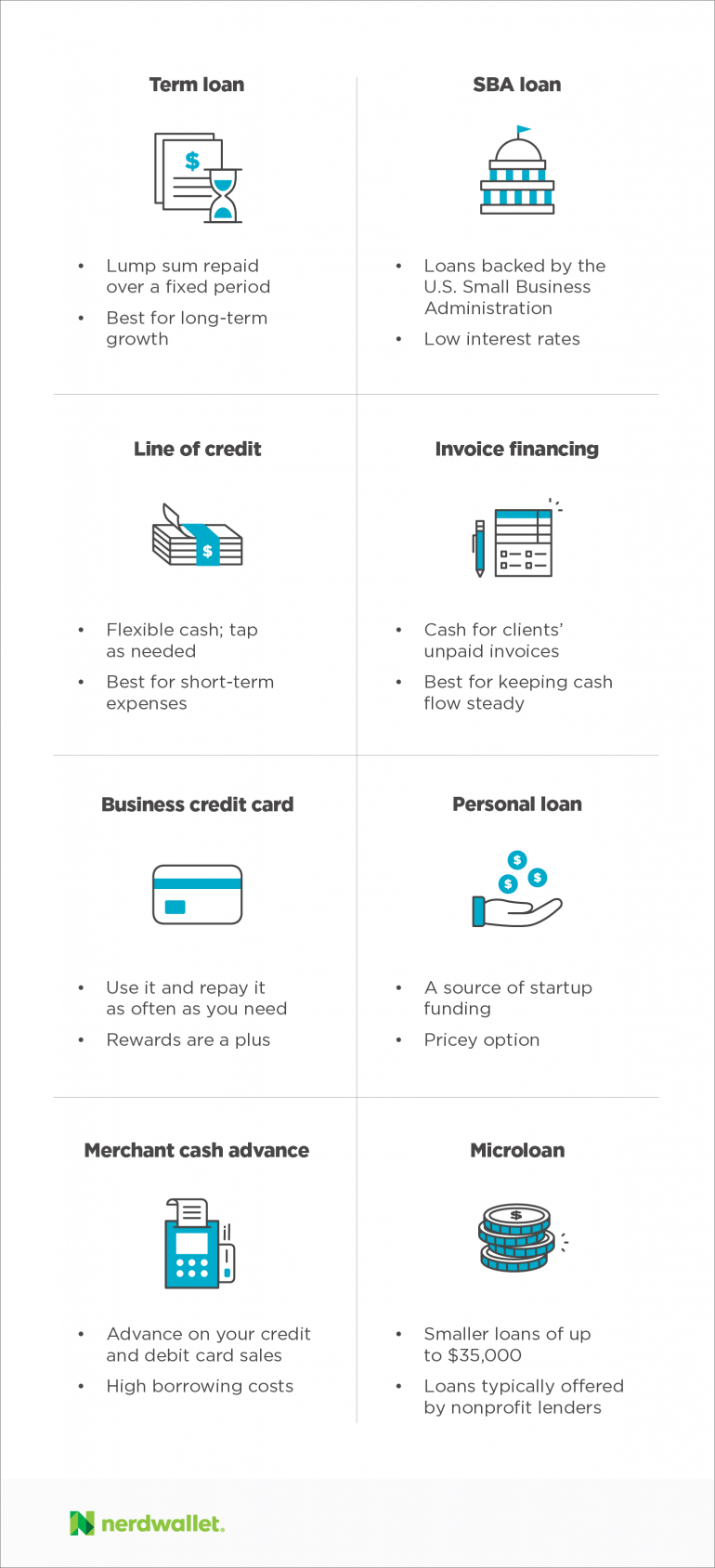

2. Decide which type of loan is right for you.

Your reasons for needing the loan will dictate the type of small-business loan you get.

If you’re starting a business, it’s virtually impossible to get a loan in your company’s first year. Lenders require cash flow to support repayment of the loan, so startups are typically immediately disqualified from financing.

Instead, you’ll have to rely on business credit cards, borrowing from friends and family, crowdfunding, personal loans or a microloan from a nonprofit lender. Here’s more information on startup business loans.

For businesses with a year or more of history and revenue, you have more financing options, including SBA loans, term loans, business lines of credit and invoice factoring.

Jump to our graphic with easy definitions of different types of financing.

[back to the top]

3. Determine the best type of small-business lender.

You can get small-business loans from several places, including banks, nonprofit microlenders and online lenders. These lenders offer products including term loans, lines of credit and accounts receivable financing.

You should approach small-business-loan shopping just as you would shopping for a car, says Suzanne Darden, a business consultant at the Alabama Small Business Development Center.

Once you determine which type of lender and financing vehicle are right for you, compare two or three similar options based on annual percentage rate (total borrowing cost) and terms. Of the loans you qualify for, choose the one with the lowest APR, as long as you are able to handle the loan’s regular payments.

Use NerdWallet’s business loan calculator to figure out your monthly payment.

Use banks when:

- You can provide collateral.

- You have good credit.

- You don’t need cash fast.

Traditional bank options include term loans, lines of credit and commercial mortgages to buy properties or refinance. Through banks, the U.S. Small Business Administration provides general small-business loans with its 7(a) loan program, short-term microloans and disaster loans. SBA loans range from about $5,000 to $5 million, with an average loan size of $371,000.

Small businesses have a tougher time getting approved due to factors including lower sales volume and cash reserves; add to that bad personal credit or no collateral (such as real estate to secure a loan), and many small-business owners come up empty-handed. Getting funded takes longer than other options — typically two to six months — but banks are usually your lowest-APR option.

Use microlenders when:

- You can’t get a traditional loan because your company is too small.

Microlenders are nonprofits that typically lend short-term loans of less than $35,000. The APR on these loans is typically higher than that of bank loans. The application may require a detailed business plan and financial statements, as well as a description of what the loan will be used for, making it a lengthy process.

Also, the size of the loans is, by definition, “micro.” But these loans may work well for smaller companies or startups that can’t qualify for traditional bank loans, due to a limited operating history, poor personal credit or a lack of collateral.

Popular microlenders include Accion Kiva, the Opportunity Fund and the Business Center for New Americans.

Use online lenders when:

- You lack collateral.

- You lack time in business.

- You need funding quickly.

Online lenders provide small-business loans and lines of credit from $500 to $500,000. The average APR on these loans ranges from 7% to 108%, depending on the lender, the type and size of the loan, the length of the repayment term, the borrower’s credit history and whether collateral is required. These lenders rarely can compete with traditional banks in terms of APR.

But approval rates are higher and funding is faster than with traditional banks — as fast as 24 hours. See NerdWallet’s reviews of online business lenders.

[back to the top]

4. Find out if you qualify.

WHAT’S YOUR CREDIT SCORE?

Your place on the credit spectrum is one factor that will determine which loans you’ll qualify for. You can get your credit report for free from each of the three major credit bureaus — Equifax, Experian and TransUnion — once a year. You can get your credit score for free from several credit card issuers as well as personal finance websites, including NerdWallet.

Banks, which as previously noted offer the least expensive small-business loans, want borrowers with credit scores at least above 680, Darden says. If your credit score falls below that threshold, consider online small-business loans for borrowers with bad credit or loans from a nonprofit microlender.

HOW LONG HAVE YOU BEEN IN BUSINESS?

In addition to your credit score, lenders will consider how long your business has been operating. You need to have been in business at least one year to qualify for most online small-business loans and at least two years to qualify for most bank loans.

DO YOU MAKE ENOUGH MONEY?

Many online lenders require a minimum annual revenue, which can range anywhere from $50,000 to $150,000. Know yours and find out the minimum a given lender requires before you apply.

CAN YOU MAKE THE PAYMENTS?

Look carefully at your business’s financials — especially cash flow — and evaluate how much you can reasonably afford to apply toward loan repayments each month. Some online lenders require daily or twice-monthly repayments, so factor that into the equation if that’s the case.

To comfortably repay your loan each month, your total income should be at least 1.25 times your total expenses, including your new repayment amount, Darden says. For example, if your business’s income is $10,000 a month and you have $7,000 worth of expenses including rent, payroll, inventory, etc., the most you can comfortably afford is $1,000 a month in loan repayments. You can use Nerdwallet’s business loan calculator to determine your loan’s affordability.

» More tips: How to qualify for a small-business loan.

[back to the top]

5. Now, gather your documents.

Once you’ve compared your options, it’s time to apply for the loans that fit your financing needs and that you qualify for.

You can apply for multiple small-business loans within a short time frame (about two weeks) without a negative effect on your personal credit score.

Depending on the lender, you’ll need to submit a combination of the following documents with your application:

- Business and personal tax returns

- Business and personal bank statements

- Business financial statements

- Business legal documents (e.g., articles of incorporation, commercial lease, franchise agreement)

[back to the top]

Small-business financing, in simple terms